Company Update / Consumer Staples / IJ / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- delivered 1Q24 net profit of Rp390bn (+30% yoy) and came above ours/consensus expectation at 35/38% (vs. 5yr avg of 21%).

- 1Q24 GPM improved significantly to 59.3% (+608bps yoy) - above ours' (56.9%) and may be sustainable for the rest of the year.

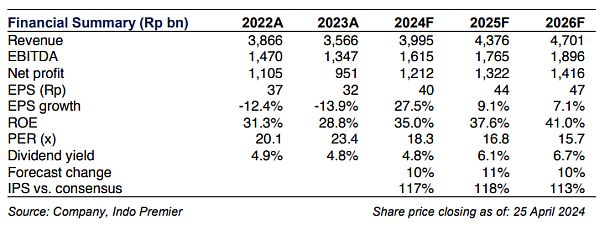

- We upgrade FY24/25F earnings by +10/11% to reflect better margins. Maintain our BUY call for with higher TP of Rp890.

1Q24 net profit came above expectations

's 1Q24 net profit of Rp390bn (+30% yoy) was above ours/consensus expectations at 35/38% vs. 5yr average of 21%. Sales grew by +16.1% yoy driven by both domestic sales growths (c.15% yoy) on the back of election spending and social aid disbursement; and stellar export sales growth of 44% yoy which now contributed c.7% to total revenue. Notably, gave longer term of payment (c. 2 weeks) at end of Mar24 to ensure product availability during the Eid holidays. GPM's rose by +608bps yoy to 59.3% was driven by lower raw material costs for F&B segment and better economies of scale on positive volume growth across segments. On the other hand, opex/sales ratio improved from 13.3% in 1Q23 to 12.7% in 1Q24 on the back of strong sales growth. Total salary/sales ratio declined to 3.6% (vs. 1Q23's 4.3%), while A&P/sales actually rose to 5.7% yoy (vs. 1Q23's 3.8%). This led to a net profit margin expansion of +397bps yoy to 37.1% in 1Q24.

Highest ever GPM attainment on a segmental basis for herbal and F&B

Segmentally, herbal/F&B segments grew by +13.3/20% yoy. F&B segment's GPM improved significantly by +1061bps to 41.8% (a quarterly record high) on the back of lower cost inputs while herbal segments' GPM recorded a new high in 1Q24 at 71.5%. The strong set of margins is deemed to be sustainable and may further improve if sugar and coffee prices normalize.

Maintain our BUY call with higher TP of Rp890

In sum, we upgrade FY24/25F earnings by +10/11% to reflect a stronger growth outlook and higher margins.La Nina expectations in 2H24F (for herbal demand) along with robust Malaysia's export trend for energy drinks are among drivers for the rest of the year. 's exposure to US$-related cost is manageable at 20-30% of COGS and is more insulated to Rupiah depreciation against US$ compared to peers. In sum, we maintain our BUY call following 1Q24's stellar results with a higher TP of Rp890 based on 22.0x FY24F PE (+0.5s.d from its 5 year average).

Sumber : IPS